Introduction

At a high level, corporate social responsibility refers to practices and policies undertaken by corporations that are intended to have a positive influence on the world. Along these same lines, there is a growing desire in many organizations to practice environment, social, and governance (ESG) principles in their everyday business operations. In fact, such practical applications of corporate responsibility are increasingly viewed as necessary and of strategic importance. While the drivers for ESG advancement may vary company to company, the implementations tend to follow similar paths including:

- Executive and Board level activities

- Operation

At the senior executive level of most organizations, ESG practices may include initiatives such as: board, executive, and management representation; policy that directs environmental and safety practices; public engagement and participation; and a management system to measure and report on those initiatives and their impact.

The challenge is to overcome complexities associated with operationalizing ESG, so that the purpose and intent are embraced throughout the organization and sustainable in day-to-day tasks. A successful ESG program requires insight into how fundamental business activities and decision- making are managed to ensure:

- The environment is respected

- Employee and public health and safety is top priority

- Operational impacts on the community are understood, and the public is engaged

- Management oversight systems accurately represent facts on the ground and enable course correction

This level of organizational diligence can be daunting; however, it can also lead to enhanced overall performance and profitability. The deep thinking and organization competencies that will deliver meaningful and sustained ESG results are well aligned with the goals and objectives of comprehensive asset management. Industrial organizations that view asset management (AM) as a vehicle to achieving sustained ESG success, will have their cake and eat it, too. ESG maturity can and should be in step with AM maturity—working in sync to deliver improved performance, reliability, risk management, and positive effects on other strategic goals.

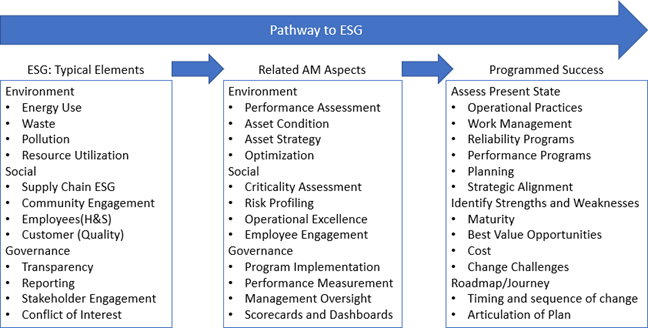

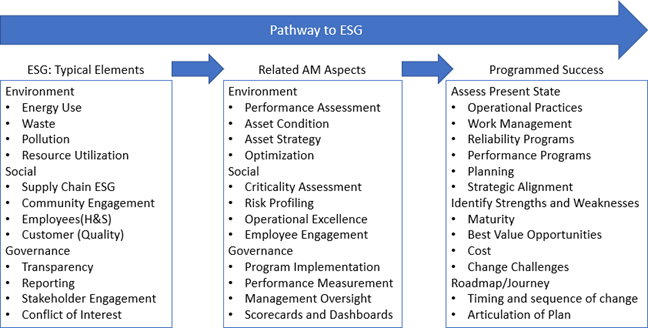

Typical ESG elements have direct lines to AM aspects and usually multiple AM aspects, as detailed in Figure 1.

Figure 1. Mapping ESG to asset management.

Achieving specific ESG objectives requires multiple AM competencies. Fortunately, many ESG objectives are enabled by common AM competencies, as indicated in the above graphic.

Identifying AM competencies necessary to achieve specific ESG goals is not difficult; but assessing present state, designing roadmaps, and deploying these competencies can be challenging for many organizations. However, the prize is great. Doing due diligence (designing an ESG plan and measuring/achieving compliance) is of utmost importance, as it will result in operational effectiveness, reliability, and profitability. ESG and AM are intrinsically related and, along with traditional success measures, can be a win-win proposition.

This whitepaper (the first in a series of three) outlines the relationship between AM and ESG. The following papers will dive deeper into: 1) the mechanics of designing ESG specifics in an AM framework; and 2) mapping “your” AM journey within the AM ecosystem.

Defining ESG from an Operational Perspective

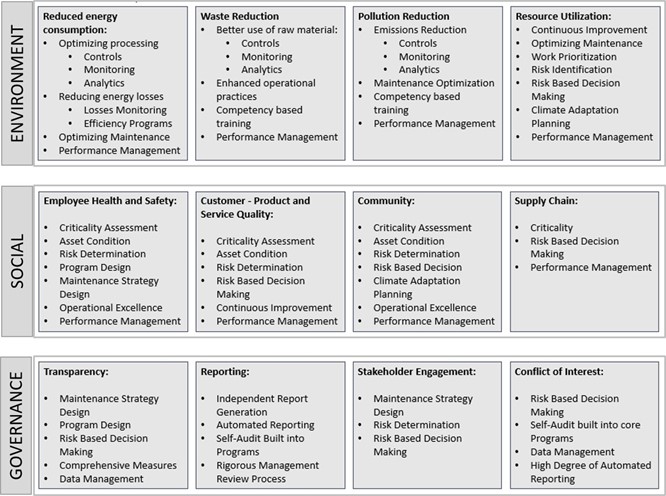

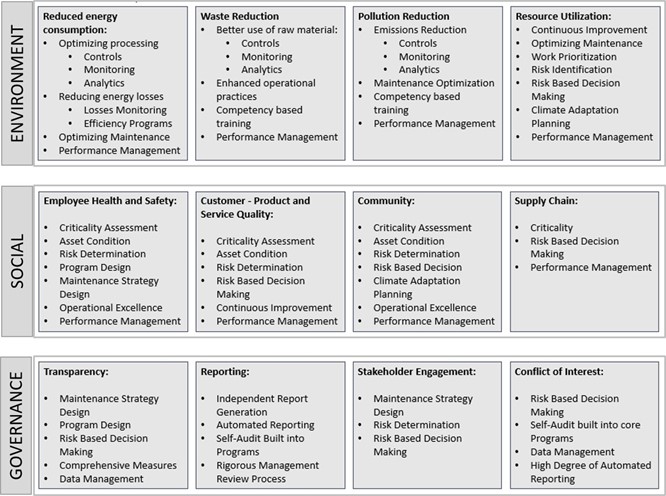

Figure 2 lists AM competencies that are directly related to the elements of ESG. While there are many strategic activities an organization should conduct to advance ESG, this paper is focused on how ESG principles can be operationalized and sustained, such that an ESG culture will be pervasive in an asset-intensive business setting.

Figure 2. Mapping ESG to asset management competencies.

It is notable that most pathways to achieving these ESG goals are clearly aspects of AM. Conceptually, this makes sense. For example: it is not surprising that enhancing maintenance and operating practices will result in better performance, greater efficiency, less waste, or even better safety.

Linking specific aspects of AM to ESG and illustrating their relationship is the goal of this paper.

ESG and AM Alignment: Environmental Elements

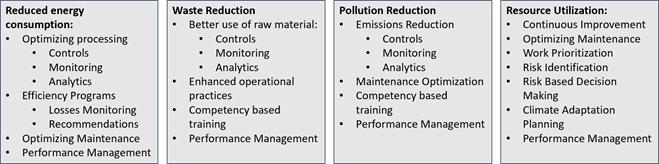

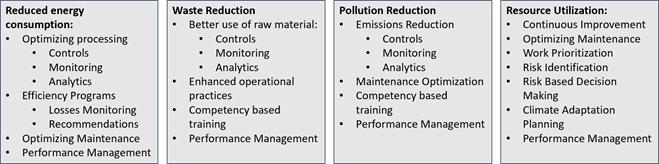

Some key environment outcomes related to ESG are detailed in Figure 3. They include:

- Reduced energy consumption

- Waste reduction

- Pollution reduction

- Optimum resource utilization

Figure 3. Operational and business activities that drive environmental outcomes.

It is natural to associate environmental performance with good operating and maintenance practices. But the essence of ESG is about enhancing environmental performance and being more responsible operationally every day. It is also about improving the ability to foresee environmental and social risks in the medium and long term, and applying these concerns to a risk-based, decision-making approach. An approach that inherently includes environmental and social concerns, goals, and objectives alongside (and with appropriate ranking) other strategic goals and objectives (safety, profitability, quality, and so forth).

In this context, the question becomes: How does the organization mature to better represent ESG values? This is where AM comes into play. The short answer is that AM discipline provides the key ingredients including: Criticality Assessment, Maintenance Strategy, Condition-Based Maintenance(CBM), Risk Based Decision Making and much more, to be discussed in the second white paper, Designing ESG within an Asset Management Framework.

To further the discussion on ESG-AM relationship from an Environmental perspective the following will be discussed:

- Maintenance Optimization

- Process Optimization

- Efficiency Programs

- Performance Management

Maintenance Optimization

Maintenance optimization is a common area of attention when attempting to impact performance (energy efficiency, waste reduction, pollution reduction, resource utilization, etc.). It is derived from:

- A better maintenance strategy—preventive maintenance (PM), CM, surveillance, and testing—to yield better asset performance via increased efficiency or waste reduction

- Doing the right maintenance (highest priority) to reduce overall asset risk and improve performance

- Doing the right amount of maintenance (e.g. CBM vs PM) to free up resources to address other priority issues and, thereby, improve performance

- Identifying and quantifying risk (accurately) to drive the best sustaining investment decisions that in turn optimize financial resources

While these tactics are not specific to the environment or safety, per se, they do ensure that safety and environmental issues are identified in a timely manner, prioritized appropriately, and acted on based on their criticality and urgency.

Furthermore, well designed maintenance strategy yields excellent information regarding asset health and risk and, therefore, is a key ingredient in CBM and risk-based decision making. Again, safety and environmental concerns attract the appropriate attention in this operating regime.

Process Optimization

Process optimization is likely the most common angle of attack to improve energy efficiency, reduce waste and pollution, and optimize resources. And this too makes sense, as it involves:

- Better process control to reduce energy losses (pressure drop, heat loss)

- Enhanced monitoring (additional instrumentation) to further identify where losses are occurring and spur corrective action

- Crude analytics (historical review of process variables) to improve the understanding of losses, waste, and pollution drivers and, as a result, identify corrections actions

The integration of all this process information with other data streams (CM data derived from maintenance strategy activities, data derived from operations rounds and testing, and performance data) can provide deep understanding of asset health, performance, and risk, and drive the right maintenance action or operational practice. This degree of design, integration, and data synthesis is the domain of AM. Although it requires a higher degree of program and data design, the results can be very significant with respect to efficiency, reduction in waste and pollution, and resource utilization.

The knowledgebase, program design, and technology are now available to facilitate the data integration and synthesis required to deliver process optimization, maintenance optimization, and risk determination in a way that was not feasible only a few years ago.

Efficiency Programs

Efficiency programs are common in many organizations that focus on energy consumption and waste/pollution reduction. However, where process data and maintenance program data are well integrated, efficiency programs can go to an even higher level. Data-rich operational environments enable digital performance management tools and emerging analytical tools to further improve performance.

It is essential that the foundational integration work (maintenance strategy design, data management, etc.) comes first to enable the data flow that feeds into advanced analytics. All too often, organizations put the cart before the horse on this key development roadmap. It is also important to internalize that the foundational activities add value, even before the advanced analytics stage. Good maintenance strategy provides good care and management of assets on its own. Advancing to analytical tools is an added (potentially very valuable) benefit.

Performance Management

Performance management is common to all ESG elements and is also necessary in all AM activities. Programs and processes, operational technology, data, analytics, risk register, etc. do not live on their own. Automation can streamline all these activities, but management oversight in the form of review, issue identification, and course correction are an absolute must and, possibly, the most poorly executed AM competency in asset-intensive industries. Governance in ESG is key to overall ESG success (not to mention a requirement). It is also key to the success of AM. This means that all activities (operations, maintenance, planning, decision making, etc.) must be defined, transparent, and measurable. And, they must have management oversight processes.

No getting around it; this is difficult for many organizations. Fortunately, the AM discipline is about designing and sustaining such oversight systems. More to come on that topic (refer to the whitepaper on: Mapping Your ESG Journey).

ESG and AM Alignment: Social Elements

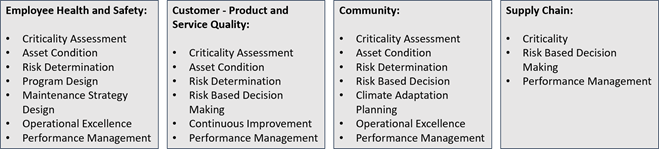

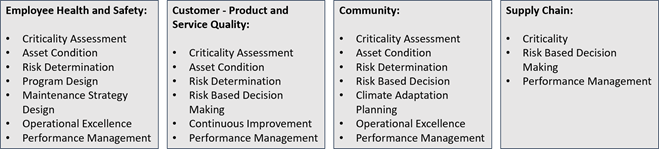

Social responsibility is a key characteristic of ESG-compliant organizations. While some important activities are related to corporate engagement and support for community-based initiatives (to name a few), there are important operationally focused business activities related to these aspects, as shown in Figure 4.

Figure 4. Operational and business activities that drive social responsibility.

As in the environmental stream, it is notable that there is an essential AM contribution to enhancing and applying an organization’s commitment to social responsibility.

Certainly, it is necessary to have a deep understanding of how assets (their condition and performance) can impact the wellbeing of employees, the community, and customers. It goes without saying, it must be rigorous and transparent in practice. And, while this makes sense, it is not always simple, yet, it is an ESG requirement. Through an AM lens, however, it need not be considered a cost. It can be a value driver.

Here are some high-level examples of what AM principles can provide:

- Foundation for social goals

- Criteria for socially responsible decision making

- Framework for considering future challenges, such as climate change

Criticality Assessment

Criticality assessment is another essential element of AM. Rigorously determining the importance of assets is the basis for determining how to maintain, sustain, plan, and operate them effectively. The more critical an asset, the more rigorous its maintenance strategy, the more critical spares required, and the more detail in operating practice. Primary factors in determining criticality include:

- Safety implications for employees and the public

- Environmental impacts

- Product quality

- Asset performance (reliability, availability)

- Profitability

- Other factors, depending on the nature of the business

In this way, AM and, more importantly, comprehensive asset management, are inextricably linked to ESG goals and objectives.

Criticality is the primary input to the design of a safety system, environmental program, and maintenance strategy, as well as risk determination.

Asset condition (health or likelihood of failure), along with criticality, determines asset risk (Criticality * Condition). Given ESG factors are key drivers in this formula, an organization’s ability to understand their assets in terms of risk is essential and a measure of their ESG maturity. From a broader perspective, it is a key determinant of an organization’s AM maturity and, more importantly, their ability to make rigorous and transparent risk-based decisions.

Risk-based decision making, enabled by criticality assessments and quality condition assessments (a function of maintenance strategy, by the way) is central to managing risks, performance, and profitability with due diligence and transparency.

Managing Future Challenges

Managing future challenges is an area of increasing focus for many businesses. As climate change impacts become better understood, businesses are turning their attention to climate adaptation in both business planning and operations. Climate adaptation will be an important feature in many businesses’ ESG tactics going forward.

Here are some key requirements to support climate adaptation planning:

- Asset criticality must be well understood

- Asset condition factors must be understood from the perspective of new risks (e.g. wind, temperature, and precipitation regimes)

- Risk calculation must be projected into the future, based on: present health, utilization plan, and new risk factors

Increasingly, businesses will need to have this competency in their organization to make the best medium- and long-term plans. For some, this will be an ESG strategic requirement. For others, it will be just good business. For all, it will require good AM discipline to get it right.

ESG and AM Alignment: Governance Elements

Governance, like environmental and social streams, has essential activities at the executive and board level. However, to establish an ESG culture throughout an organization, it is necessary that principles and strategic goals are represented, applied, measured, and managed in all operational areas. This is a cornerstone to sustaining ESG goals and objectives.

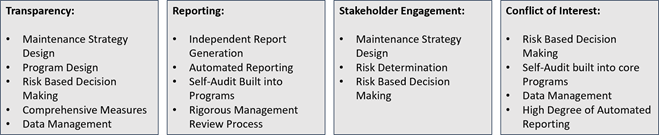

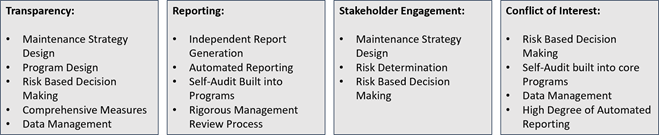

As detailed in Figure 5, governance categories related to ESG include:

- Transparency

- Reporting

- Stakeholder engagement

- Conflict of interest

Figure 5. Operational and business activities that drive governance.

While the categories of governance are obvious, operationalizing them, in a rigorous way, is not simple and not typically embedded within operational activities. In an ESG world, it is necessary to have the following in place:

- Clear lines from strategy to action

- Transparent decision-making methodology, as it relates to sustaining assets

- Performance management across the organization

- Infrastructure that supports clear and accurate measurement in support of performance management

These ESG fundamentals are also common AM fundamentals, and are necessary competencies for a business to move toward AM maturity.

Fortunately, the purpose of AM development is, typically, to enhance performance, which is the essence of ESG (at least from an environment and social perspective). It can be asserted that ESG development is, in practice, equivalent to maturing an organization’s AM competency. And a business should expect that AM maturation will advance its ESG goals, while enhancing its performance and/or bottom line. Functionally and operationally, they are not different things!

Note that every category in the environment and social streams included performance management. This is not by chance. The essence of ESG (and AM) is that business activities are transparent, highly measurable, and provide the means by which management has appropriate oversight to understand status and issues. Not to be confused with micro-management, though! Well executed performance management provides the right intel to the right people in the organization. AM should have a streamlining effect and, importantly, reduce much decision making to processes. Of course, strategic decision making is the realm of senior management, but AM enables an effective way to have high-quality decision making throughout the organization’s business activities.

Consider the following examples of governance from an ESG and AM perspective:

- Measurement of foundational programs (criticality, maintenance strategy)

- Measures (assets, programs, people)

- Management oversight

- Risk-based decision making

Measurement and Management of Foundational Programs (Criticality & Maintenance Strategy)

Criticality and maintenance strategy are cornerstone activities at the heart of AM programs. Therefore, oversight and management of these programs is of utmost importance. To be successful in AM and ESG, an organization must:

- Apply criticality assessment to all significant assets

- Leverage criticality to design and deploy maintenance strategy

- Apply a reasonable degree of rigor in these programs, as opposed to exhausting efforts (unsustainable, but common error)

- Be collaborative and engaging, as opposed to “engineered in isolation”

- Systematically use data from these activities to inform asset health, risk, risk-based decision making, and condition-based maintenance

- Supply information to analytical tools and systems

Further, from a Governance perspective, an organization needs to have measures and processes to ensure that these foundational activities (Criticality and Maintenance Strategy development, Risk Determination) are functioning.

Measures (Assets, Programs, & People)

Central to ESG is transparency and reporting. Operational activities related to environmental and social responsibility must be manifest in operating programs and well measured to illustrate and report due diligence. Management must have an accurate and deep understanding of:

- How well assets are working and where challenges exist

- Employee performance in the execution of their duties

- Status of the core programs that determine asset performance and health, and drive risk- based decision making

Therefore, measurement must be inherent in all programs across the AM spectrum—from maintenance to operations, planning, AM programming, etc.

Management Oversight

Creating leading and lagging measures (scorecards, dashboards, reports) is a technical effort requiring program design, data design, reporting, and communication tools. But the effort only adds value if there is a committed management oversight process.

This means that all levels of management must have a process for review and feedback on a regular basis (weeks and months). The right amount of performance data, supported by easy drill- down into detail, must be presented to each level of management. For many organizations, this represents the greatest ESG and AM challenges. But it is at the heart of ESG’s responsibility system and at the heart of a robust AM program that seeks continuous improvement.

Risk-Based Decision Making

A key outcome of a comprehensive AM program is the ability for a business to have a strong understanding of its risks and utilize this knowledge to make the best possible decisions. For businesses with ESG goals and objectives, this rigorous risk-based approach provides for transparent and substantiated decision making. For all business, quality risk-based decision making enables best performance and profitability, while demonstrating responsible management practices.

ESG and Asset Management: Designing the Journey

So, conceptually, it appears that ESG and AM are well related. But how does that really look inside an asset-intensive business? How does ESG become designed within an AM ecosystem to deliver the desired ESG outcomes?

Stay tuned for the following white papers, where we take a deeper dive to fully explore the AM practices that need to be applied:

- Designing ESG within an Asset Management Framework

- Mapping Your ESG Journey using the Asset Management Ecosystem

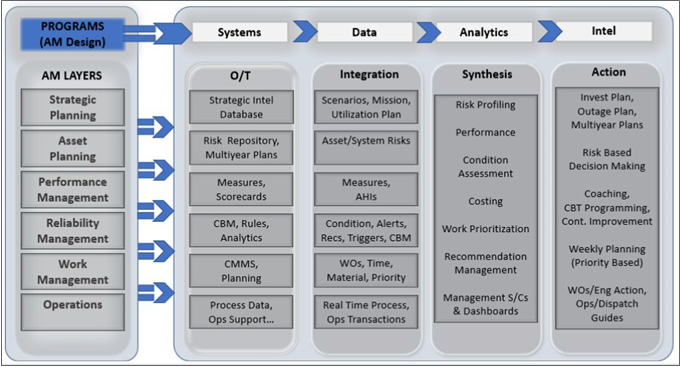

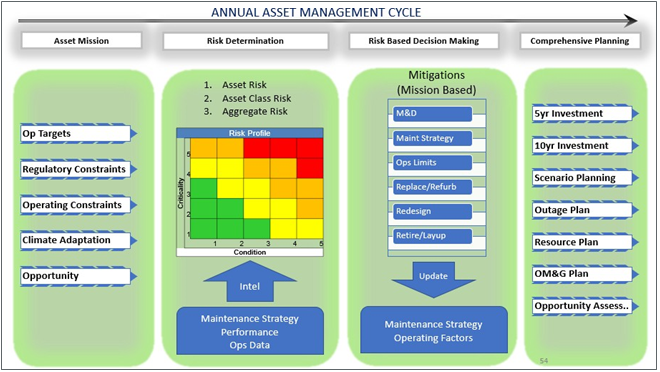

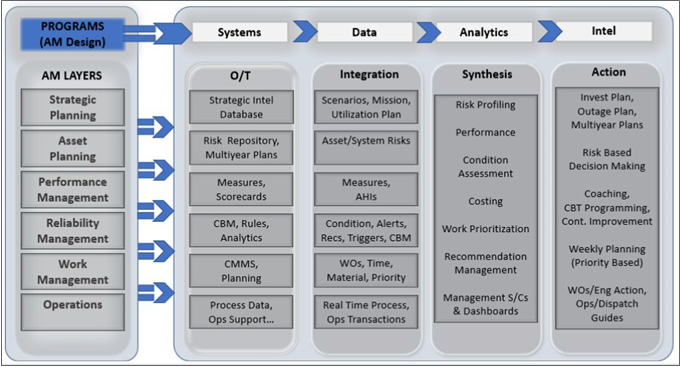

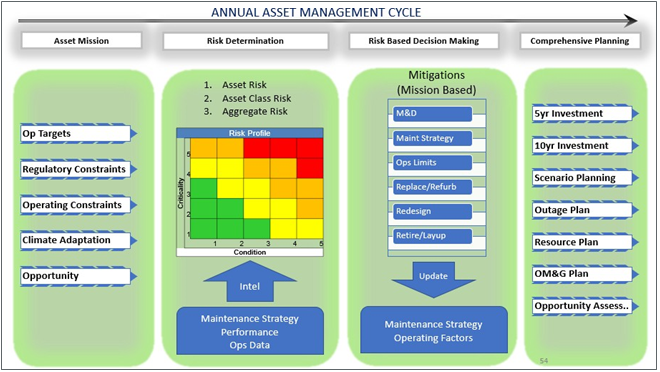

These papers will leverage a structured view of the AM ecosystem, AM programming, and the AM cycle to help with visualization and connection. Figures 6 and 7 provide a glimpse into what’s next.

Figure 6. Asset management ecosystem.

Figure 7. Annual asset management cycle.

These structured views will support further discussion that many of the elements of ESG and AM are highly inter-related and should be thought of in a holistic manner, rather than a series of disparate activities. And in its entirety, the white paper series will demonstrate that ESG and AM development are value-add propositions worth pursuing.

Authors:

Chris Colson, Allied Reliability & Rob Macneil, MacNeil Asset Performance Management Inc.